Adani Energy Solutions records solid performance in Q1FY26

Ahmedabad, 24July 2025: Adani Energy Solutions Limited (“AESL”), part of the globally diversified Adani portfolio and the largest private transmission and distribution company in India with a large smart metering portfolio, today announced its financial and operational performance for the quarterended June 30, 2025.

“We are pleased to report another robust quarter. The effective on-ground execution&focused O&M enabling consistent progress on the project capex growth continues to be our key performance yardstick as we stayfocused on unlocking the huge locked-in growth potential in our core business segments. During this quarter, the company made strides to commission three new transmission lines and achieved industry leading daily run-rate in terms of smart meters installation. We expect to not only maintain the same momentum,but further enhance our pursuitof timely completion of our under-construction project pipeline.In terms of business outlook, as the sector offers immense opportunities backed by regulatory support andstrong underlying factors like power demandand changing energy mix, AESL remains excited to tap thefresh opportunities falling within the risk-rewardmatrix and capital allocation policy of the company. We anticipate a significant increase in AESL’s capex roll-out and new bid activity from Q2, as the monsoon subsides,” said Kandarp Patel, CEO, Adani Energy Solutions

Q1 FY26 Highlights:

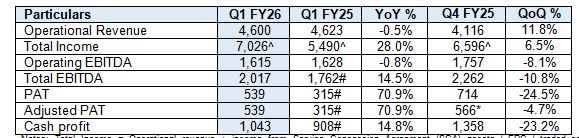

Consolidated Financial Performance: (Rs crore)

Notes: Total Income = Operational revenue + income from Service Concession Agreement (SCA) assets / EPC / traded goods + One time income/expense + Other Income; Total EBITDA = Operating EBITDA plus other income, one-time regulatory income, adjusted for CSR exp.; Cash profit calculated as PAT + Depreciation and amortization expenses + Deferred Tax + MTM option loss); ^Includes SCA income of Rs 1,924 crore in Q1 FY26 vs Rs 646 crore in Q1FY25 and 1,804 crore in Q4FY25;#Adjusted for an exceptional item due to carve-out of the Dahanu power plant of Rs 1,506 crore; *Adjusted for regulatory income of Rs 148 crore in Q4FY25 in T&D segments

Notes: Total Income = Operational revenue + income from Service Concession Agreement (SCA) assets / EPC / traded goods + One time income/expense + Other Income; Total EBITDA = Operating EBITDA plus other income, one-time regulatory income, adjusted for CSR exp.; Cash profit calculated as PAT + Depreciation and amortization expenses + Deferred Tax + MTM option loss); ^Includes SCA income of Rs 1,924 crore in Q1 FY26 vs Rs 646 crore in Q1FY25 and 1,804 crore in Q4FY25;#Adjusted for an exceptional item due to carve-out of the Dahanu power plant of Rs 1,506 crore; *Adjusted for regulatory income of Rs 148 crore in Q4FY25 in T&D segments

Revenue:

• During Q1FY26, the total income of Rs 7,026 crore grew by 28% due to stable operating performance, higher SCA,EPC, and treasury income • The operational revenue of Rs4,600 croreended flat YoY with modest contribution from the new transmission assetsdue to recent commissioning (MP–II in Q3FY25 and Khavda Ph-II-A, KPS – 1 and Sangod in the later part of Q1FY26)which was largely offset by the normal decline in the revenue of cost-plus transmission assets • The contribution from the newly commissioned transmission assets should meaningfully improve from the next quarter onwards. The revenue in the Distribution segmentwas soft due to the earlyarrival of monsoonresulting in flat volume growth in the Mumbai distribution area

Also Read: UK Opens Ballot for India Young Professionals Scheme: Apply Before July 24

EBITDA:

• Consolidated EBITDAfor Q1FY26increasedby 14% to Rs 2,017 crore,resulting from steady transmission and distribution revenue,growing contribution from smart meter andEPC &other income • The operational EBITDA of Rs1,615 croreended flat YoYdue tolower operational EBITDA in Mumbai distribution business due to higher depreciationon account of Dahanu carve-out and lower capitalizationas against capex of Rs 341 crore,offsetting the EBITDA contribution from smart meter business. The transmission business EBITDA was flat and continues to maintain the industry’s leading operating EBITDA margin of 92%

PAT:

Q1FY26 PAT of Rs 539 crore increased by 71% YoY due to double-digit growth in total EBITDA and aided by lower depreciation of Rs 33 crore YoY and net tax outgo which was down by Rs 19 crore YoY

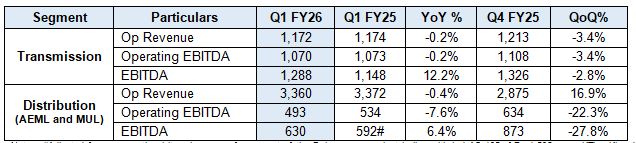

Segment-wise Financial Highlights: (Rs crore)

Notes: #Adjusted for an exceptional item because of carve-out of the Dahanu power plant in line with Ind AS 105 of Rs 1,506 crore; KTL – Khavda Phase II Part-A, KPS 1 – Khavda Pooling Station – 1, STSL: Sangod Transmission; AEML: Adani Electricity Mumbai Ltd; MUL: MPSEZ (Mundra) Utility Ltd;

Notes: #Adjusted for an exceptional item because of carve-out of the Dahanu power plant in line with Ind AS 105 of Rs 1,506 crore; KTL – Khavda Phase II Part-A, KPS 1 – Khavda Pooling Station – 1, STSL: Sangod Transmission; AEML: Adani Electricity Mumbai Ltd; MUL: MPSEZ (Mundra) Utility Ltd;

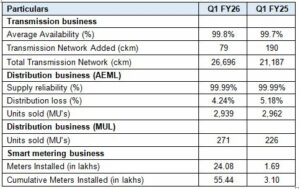

Segment-wise Key Operational Highlights:

Transmission business:

• The company reported strong operational parameters during the quarter, with an average system availability of over 99.8%. Robust line availability resulted in an incentive income of Rs 29crore in Q1FY26 reflecting the superior O&M practices in place • The company has fully commissioned Khavda Phase II Part-A, KPS-1 and Sangod during the quarter • Added 79circuit kilometers of transmission network to the operational network with total transmission network at 26,696circuit kilometers

Distribution business (AEML Mumbai and MUL Mundra):

• AEML, the Mumbai distribution business, witnessed flat volumes at 2,939 million units due to the early arrival of the monsoon season • The distribution lossin AEML was the lowest ever at 4.24% in Q1 FY26

Also Read: IEX Shares Crash 26% After Power Market Coupling Gets Green Light

Segment-wise Progress andOutlook:

Transmission:

• Robust under construction project pipeline of 13 projects worth Rs 59,304crorearecurrently under the execution phase • The company expectsto fully commissionNorth Karanpura, WRSR (Narendra – Pune), Mumbai HVDC and Khavda Phase-III-A (Halvad) in FY26 in addition to three lines commissioned in Q1 FY26 • The near-term transmission tendering pipeline is solid at ~Rs 89,864 crore with two large HVDC projects part of the pipeline

Distribution:

• The distribution business recorded a steady business performance. AEML’s Regulated Asset Base (RAB)stands at Rs 9,433crores (Equity of Rs 5,024 crores and Debt of Rs 4,409 crores)as of Q1FY26, recording a growth of 13% YoY

Smart Meters:

• Installed 55.4 lakh smart meters as of Q1FY26. The company plans to install at least 70 lakh new meters in FY26, thereby achieving a cumulative number ofminimum~1 crore meters by the end of FY26

• The under-implementation pipeline stands at 22.8 million smart meters, comprising nine projects with a revenue potential of over Rs 27,195 crore

ESGUpdates:

• AESL’s ESG score by Sustainalytics improved to 25.1 from 27.9under ‘Medium Risk’ category in July 2025, surpassing the global electric utility industry average of 36.9 • FTSE reaffirms AESL as a constituent of FTSE4Good index series (June 2025) with an ESG score of 4.4, well above the industry average of 2.9 and placing us amongst the top 6 global utilities. The company scored 5/5 in Governance, 4.3/5 in Social, and 4/5 in Environment • CDP Supply Chain 2024 score improved to –A (Leadership band) from B (Management band) • AEML hosted “Pravartak,” the Industry Conclave 2025, bringing together industry leaders, experts, and customers to explore innovations in green buildings, EV infrastructure, bus duct technology, and centralized cooling system

Also Read: Adani University ushers in future-ready Cohort with Navdiksha 2025