Federal Reserve is expected to maintain its aggressive stance in Monetary policy Meeting

When the US Federal Reserve ends its two-day monetary policy meeting on Wednesday, December 13, it is generally expected to keep policy rates in the current range of 5.25 to 5.50 %.

Inflation is expected to be more than 2% target rate

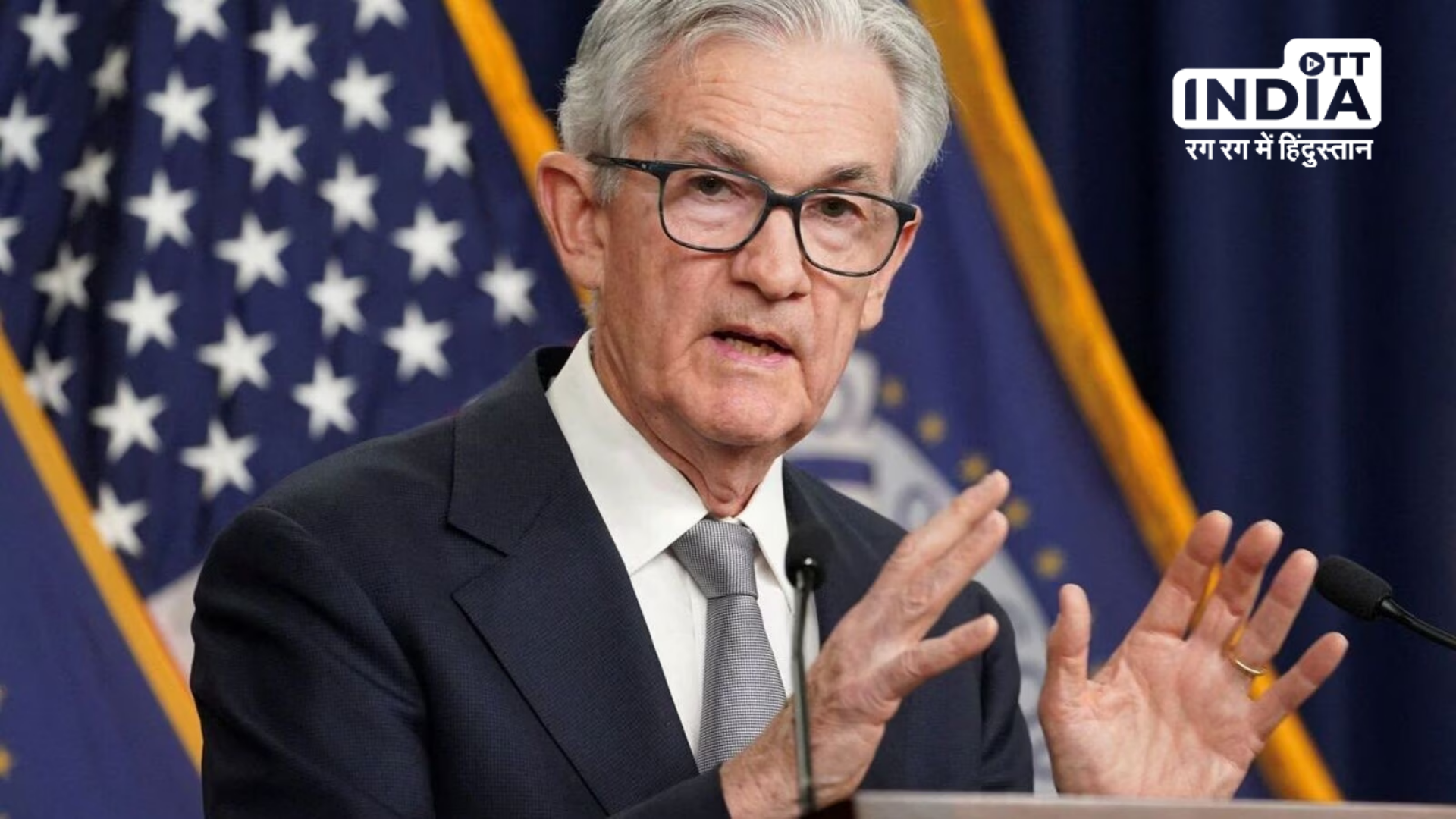

In addition, the US Federal Reserve is anticipated to maintain its aggressive stance as long as inflation is above its objective of 2%. The Consumer Price Index (CPI) increased 3.1% in November, as predicted by Reuters' survey of experts. The labor market is still tight even though inflation is declining. A Reuters story claims that US job growth picked up speed in November and the unemployment rate dropped to 3.7%. These indicators of a robust labor market may have dispelled financial market bets that an interest rate cut would come early in the next year. Experts noted that although no change in interest rates is anticipated, the market will pay close attention to Fed Chair Jerome Powell's remarks regarding inflation and growth. Rate increases are over, according to Sandeep Raina, Executive Vice President-Research at Nuvama Professional Clients Group. However, the Fed Governor's remarks about inflation, which is still higher than anticipated, bond yields, and GDP growth are the main things to keep an eye on today. Retail sales, the CPI (excluding gasoline and food), and unemployment would also be important metrics to track. According to Raina, the current inflation dot plot is 2.7%, and any change in this would be a significant vector for change.Labor market and inflation will be monitored to decide on policy rate

The Head of Retail Research at HDFC Securities, Deepak Jasani, predicts that the Fed won't make a suggestion that it will stop raising interest rates. According to Jasani, the extent of prospective interest rate decreases and their pace of implementation will be determined by closely observing the Fed's remarks regarding their forecasts regarding the labor market and inflation. Also read: RBI Monetary Policy Meet: Policy rate remains unchanged at 6.50% In the latter part of 2024, the market anticipates a rate cut from the Federal Reserve. The Fed has, however, repeatedly stated that its monetary policy will be determined by forthcoming data. Experts currently predict that the Fed won't raise interest rates from their current level. Even rate reductions, though, are far off. OTT India updates you with the latest news, Country’s no.1 digital news platform OTT India, Keeps you updated with national, and international news from all around the world. For more such updates, download the OTT India app on your Android and IOS device. Next Story