Stock market crash: 94 lakh crores gone! What should mutual fund investors do now?

Stock market crash: Foreign institutional investors (FIIs) have been continuously selling for the last five months. On the contrary, domestic institutional investors (DIIs) are buying. While Life Insurance Corporation of India is the largest DII in the country. The effect of the recession in the last five months is clearly visible on LIC's portfolio as well.

In the first 2 months of 2025, it has faced a huge decline in its stock holdings. The value of LIC's portfolio has fallen from Rs 14.9 lakh crore in December 2024 to Rs 13.4 lakh crore by the end of February 2025. This decline is one of the biggest losses in LIC's history.

Stock market crash, 94 lakh crores gone

This decline in LIC's portfolio is a reflection of the larger market crisis. Smallcap and midcap stocks have performed the worst since the COVID crash. However, large stocks, in which LIC has significant stakes, have also not been untouched by this downturn.

A sharp decline in heavyweights like ITC, TCS, and SBI has plunged LIC's portfolio into a deep red sea.

Also Read: Market closed with a fall, these 4 big reasons and RIL-HDFC shares faltered

According to a report by Economics Times, LIC's second-largest equity investment is in ITC. An 18 per cent decline in ITC shares has wiped out about Rs 17,000 crore from LIC's portfolio. Tech giants TCS and Infosys, in which LIC holds 4.75% and 10.58% stakes respectively, have also taken a huge hit.

Due to the fall in these shares, LIC's portfolio has suffered a loss of Rs 10,509 crore and Rs 7,640 crore.

How much loss from the finance sector

LIC has also suffered a huge blow in the banking and financial sector. The value of LIC's 9.13 percent stake in SBI has declined by Rs 8,568 crore, while the value of its 7.14 percent stake in ICICI Bank has declined by Rs 3,179 crore.

Also Read: Amidst chaos in the stock market, 2 companies earned 39 thousand crores last week

Jio Financial Services, whose shares have fallen by a massive 30.5 percent, has caused a loss of Rs 3,546 crore from LIC's portfolio. Other major stocks like L&T, HCL Tech, and M&M have also registered double-digit losses this year.

How many companies are in LIC's portfolio

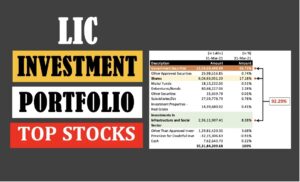

LIC's equity portfolio is spread across more than 310 companies, where it holds more than 1 percent stake. The list of companies with less than this is not revealed.

This slowdown has hit LIC's portfolio hard, with financial companies, IT giants, and industrial companies being the worst hit. LIC has lost more than Rs 1,000 crore in at least 35 stocks this year.

Slowdown has hit LIC's portfolio hard

LIC's biggest holdings include Reliance Industries (Rs 1,03,727 crore), ITC (Rs 75,780 crore), Infosys (Rs 67,055 crore), HDFC Bank (Rs 62,814 crore), TCS (Rs 59,857 crore), SBI (Rs 55,597 crore), and L&T (Rs 54,215 crore).

However, LIC's portfolio also has some shining stars, such as Bajaj Finance, Kotak Mahindra Bank, Maruti Suzuki, Bajaj Finserv, and SBI Cards, which have beaten the market slowdown and delivered profits.

Can the market fall further?

Given the current market conditions and selling pressure, LIC's portfolio is expected to decline further. LIC has historically shown the ability to withstand market volatility, but the crisis is not over yet due to foreign investors selling on Nifty and Sensex and the decline in smallcap and midcap stocks.

LIC's portfolio also has some shining stars

Analysts believe that after the Nifty fell 16 per cent from its top, its TMM PE multiple has fallen below 20 levels for the first time in the last 32 months, leading to a decline in valuations. However, the market is unlikely to recover until the FIIs' stance changes. In the last 5 months, FIIs have sold Indian stocks worth more than Rs 3 lakh crore in the equity cash segment.

Analysts believe that after the Nifty fell 16 per cent from its top

Kotak Institutional Equities believes that the Nifty will remain mainly in a limited range this year, while Citi Research recently forecast a market correction to 26,000 levels by December 2025, indicating a 13% increase from current levels. Morgan Stanley believes India will once again outperform emerging markets with macro stability and rising consumption.

All eyes are on LIC's ability to navigate this storm and balance policyholder returns, as this turbulent phase in equity markets is likely to continue till 2025

Summary

Life Insurance Corporation (LIC), India's largest domestic institutional investor, has seen a loss of Rs 1.45 lakh crore in its equity holdings in the first two months of 2025. Along with the decline in midcap and smallcap stocks in the market, big stocks like ITC, TCS, and SBI have also suffered heavy losses

.