GST Reform: Watching IPL now become expensive, ticket prices will increase by this much

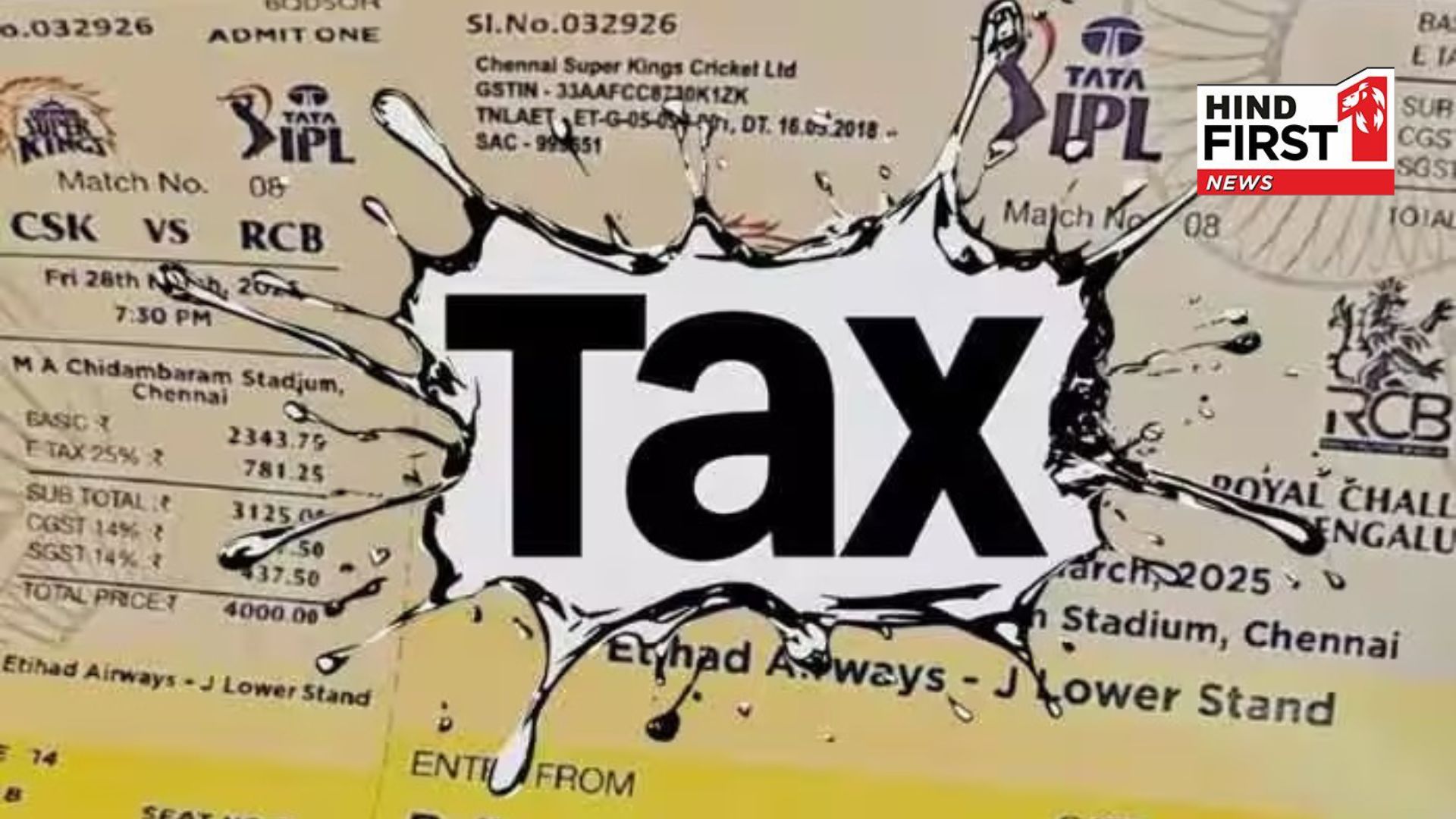

If you go to the stadium for watching Indian Premier League (IPL) then be ready to pay extra money for your ticket. Now 40 percent GST will be levied on IPL tickets.

GST Reform: The new rates of Goods and Services Tax (GST) are now going to affect cricket as well. Tickets for the world's biggest league Indian Premier League (IPL) are going to be expensive. Due to this, the pockets of the fans will become more loose on going to the stadium to watch the match. In the GST Council meeting held in New Delhi on September 3 under the chairmanship of Finance Minister Nirmala Sitharaman, it was decided to increase the GST on IPL tickets. It has been increased by 12 percent. Its effect can be seen during IPL 2026  Earlier, 28% GST was levied on IPL tickets of Rs 1000. This made the total price of the ticket Rs 1280. According to the new GST reform rate, the price of this ticket will be Rs 1400. That is, you will have to pay Rs 120 extra. Similarly, on Rs 500, instead of Rs 640, Rs 700 to be paid. At the same time, fans will have to pay Rs 2800 instead of 2560 on a ticket of 2000. Its effect can be seen in the stadium during IPL 2026.

Earlier, 28% GST was levied on IPL tickets of Rs 1000. This made the total price of the ticket Rs 1280. According to the new GST reform rate, the price of this ticket will be Rs 1400. That is, you will have to pay Rs 120 extra. Similarly, on Rs 500, instead of Rs 640, Rs 700 to be paid. At the same time, fans will have to pay Rs 2800 instead of 2560 on a ticket of 2000. Its effect can be seen in the stadium during IPL 2026.

Due to this, the fans will have to loosen their pockets more.

GST will be levied on tickets by this much percent

In the GST Council meeting, it was decided to impose 40 percent GST on IPL tickets. Earlier it was 28 percent. Due to this, IPL tickets may become more expensive. This will have a direct impact on the pockets of ticket fans. If they go to the stadium to watch the match, then they will have to pay more to get the ticket. Earlier, 28% GST was levied on IPL tickets of Rs 1000. This made the total price of the ticket Rs 1280. According to the new GST reform rate, the price of this ticket will be Rs 1400. That is, you will have to pay Rs 120 extra. Similarly, on Rs 500, instead of Rs 640, Rs 700 to be paid. At the same time, fans will have to pay Rs 2800 instead of 2560 on a ticket of 2000. Its effect can be seen in the stadium during IPL 2026.

Earlier, 28% GST was levied on IPL tickets of Rs 1000. This made the total price of the ticket Rs 1280. According to the new GST reform rate, the price of this ticket will be Rs 1400. That is, you will have to pay Rs 120 extra. Similarly, on Rs 500, instead of Rs 640, Rs 700 to be paid. At the same time, fans will have to pay Rs 2800 instead of 2560 on a ticket of 2000. Its effect can be seen in the stadium during IPL 2026. There may be a shortage of fans in the stadium

If the price of IPL tickets increases, there may be a shortage of fans in the stadium. During IPL matches, a large number of fans go to the stadium to enjoy the match, but now their number may decrease. This may affect the popularity of IPL. On the other hand, GST has not been imposed on recognized sports events.Summary

If the price of a ticket for a recognized sports event is Rs 500, then there will be no GST on it, while 18 percent GST will be levied on tickets priced above that. Apart from this, the GST Council has also decided to impose 40 percent GST on activities like betting, gambling, lottery, horse racing and online money gaming. Also Read: Afghanistan Stun Pakistan by 18 Runs in T20 Tri-Series Also Read: Secret of Team India's 'HAT', It can become a guarantee of victory in Asia Cup Next Story